Abstract: How does intermediation in the housing market affect an economy's house price distribution, trade volume, and welfare?

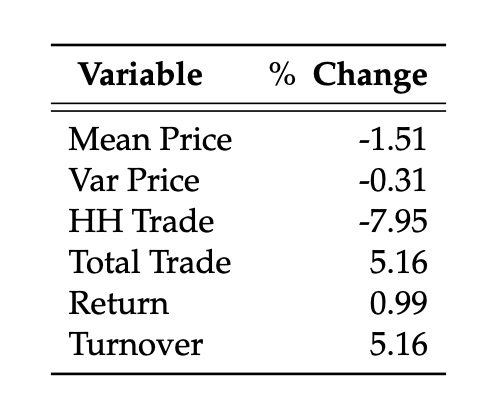

I study flipping houses - fast buying and reselling houses, which has become more prevalent in recent years. While more flipping increases market thickness, it also involves intermediaries holding housing assets instead of households. Which effect dominates for welfare? To answer these questions, I develop a decentralized trade model with intermediaries with two-sided heterogeneity in inventory and housing asset valuation, where households trade houses with each other or with flippers. Search is random, information is asymmetric, and household valuations evolve stochastically. Using a universe of administrative transaction data from Ireland, I document a steady increase in house prices, trade volume, and flipped transactions between 2012 and 2022. In particular, I find that the number of flipped transactions doubled. Through a calibrated model, I use an increase in the mass of flippers to cause an increase in flipping. This increase in flipping led to a 1.5% decrease in average house prices, implying the increase in house prices seen in the data was not caused by flippers, but instead by the decrease in mortgage rates.

The increase in flipping in the model caused a modest increase in trade volume as compared to the data.

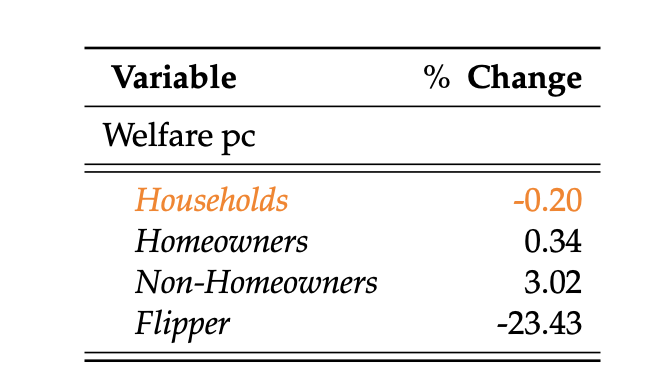

Finally, I find the increase in flipping caused an average decrease in household welfare of 0.2%, chiefly by decreasing the steady state fraction of households owning a home. On the positive side, misallocation of housing due to search frictions decreased.

Question

What is the role of intermediation on house price distribution,

trade volume and welfare in a decentralized market for houses?

Fraction of flipped transactions in Ireland between 2012 and 2021.

Flipped house in a data: bought and next sold within 2 years

(following literature, robustness checks for 1 and 4 years).

Model

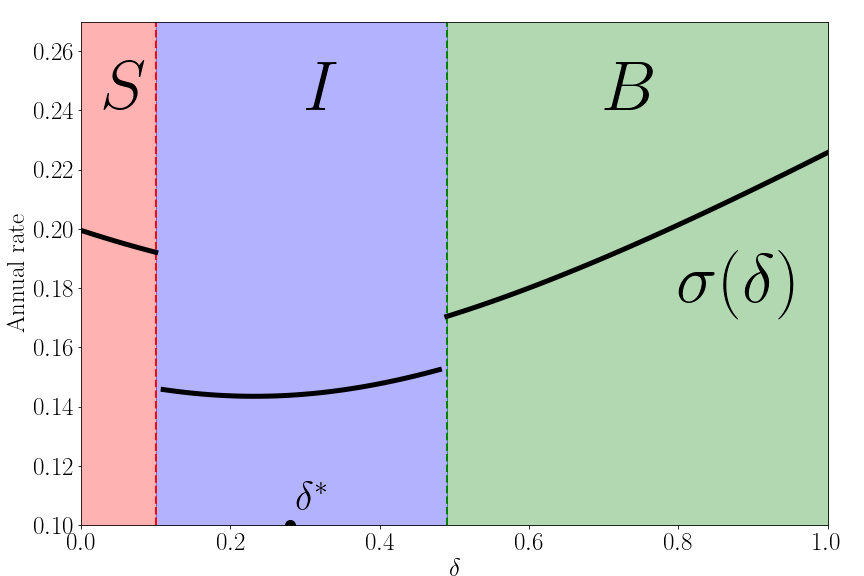

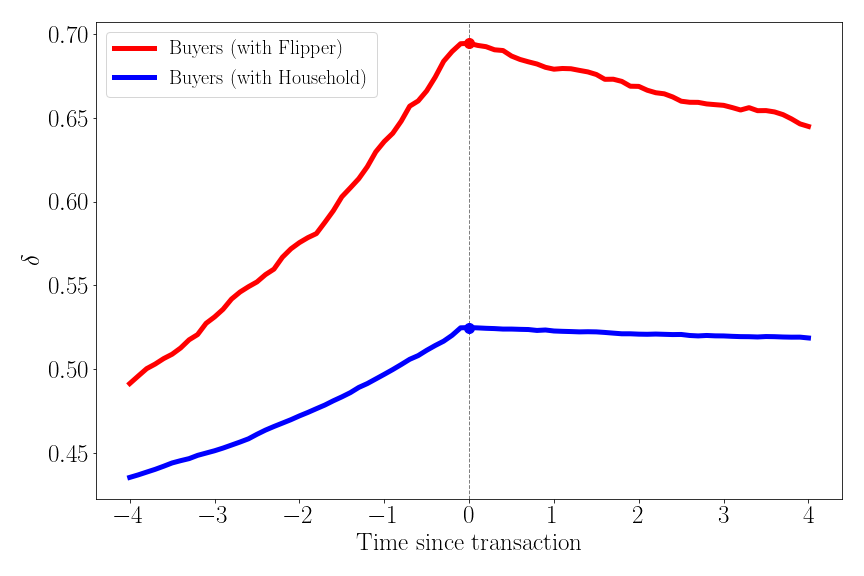

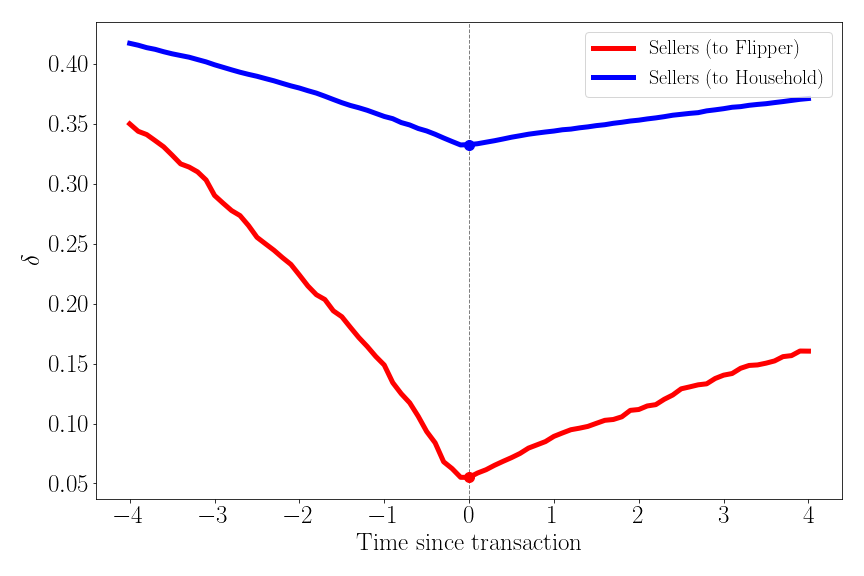

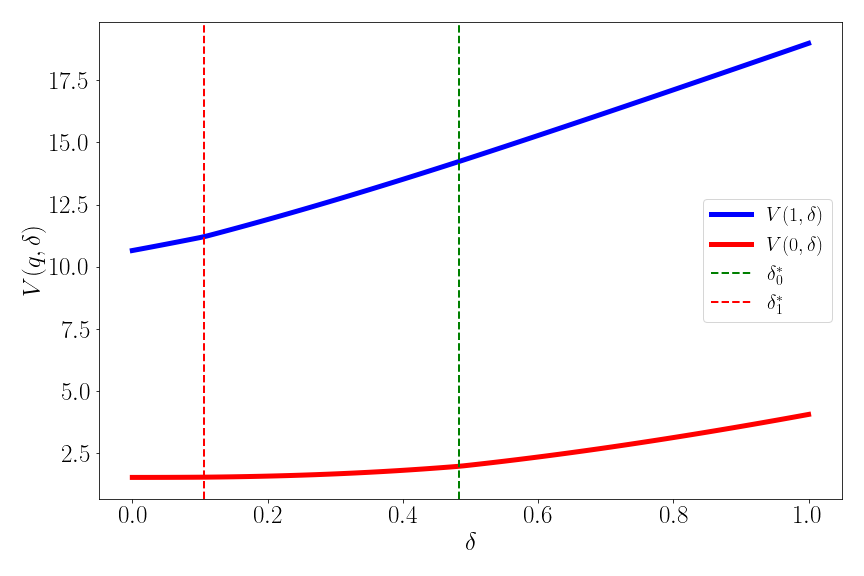

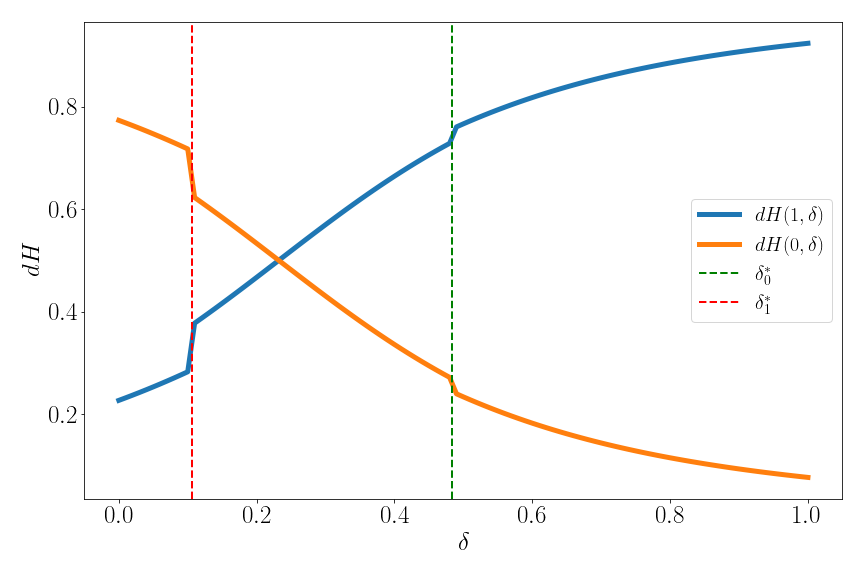

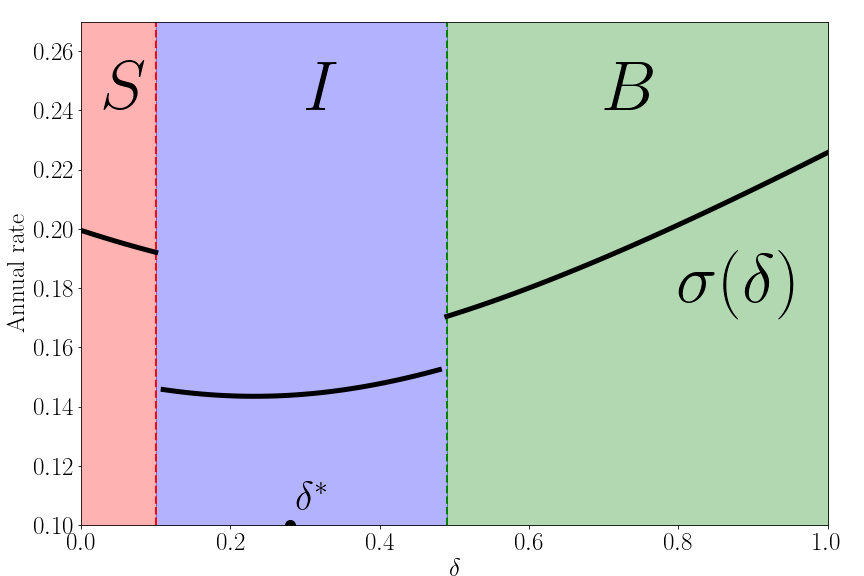

Model of decentralized trade with an intermediary. House is homogenous good, taste for it$\delta$, heterogenous across households. The search is random, the types are heterogeneous, and the information is asymmetric. Flipper meets faster and doesn't observe $\delta$ when proposes a price. Key equation $\Delta V(\delta)$ reservation value of hh:

$$\sigma(\delta)\Delta V(\delta)=\delta+\gamma\int_0^1\Delta

V(\delta')dG(\delta')+\lambda F(0)\Delta V(\delta_1)1[\delta<\delta_1]+\lambda F(1)\Delta V(\delta_0) 1[\delta>\delta_0]+$$

$$+\frac{\rho}{2}\int_\delta^1 \Delta V(\delta') dH(0,\delta')+\frac{\rho}{2}\int_0^\delta \Delta V(\delta') dH(1,\delta')$$

where endogenous discount rate $\sigma(\delta)$:

$$\sigma(\delta)=r+\gamma+\lambda F(0) 1[\delta<\delta_1]+\lambda F(1) 1[\delta>\delta_0]+\frac{\rho}{2}\int_\delta^1 dH(0,\delta')+\frac{\rho}{2}\int_0^\delta dH(1,\delta')$$

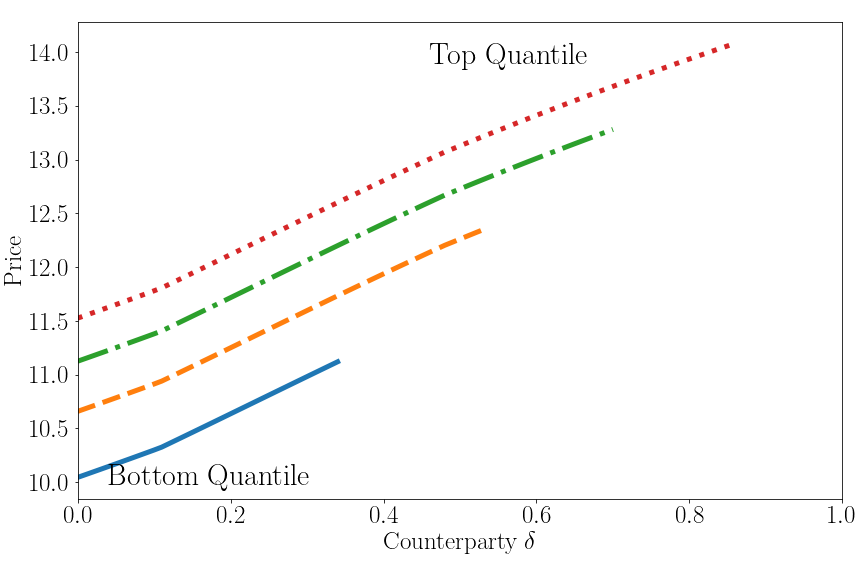

Low types homeowners sell to flipper, high types non-owners buy from flipper. Inter-household trade concentrated around middle type $\delta^*$

Conclusion

I develop a model of decentralized trade with intermediary. Search is random, types are heterogeneous, and information is asymmetric.

- I endogenize middleman's asset holding.

- I developed an algorithm for cutoff equilibrium with continuous time methods.

- To study intermediation ↑ ↔ the mass of intermediary ↑.

I use the universe of house transaction data in Ireland.

- I use it to identify flippers ≈ double between 2012 and 2021 in Ireland.

I quantify the effects of intermediation.

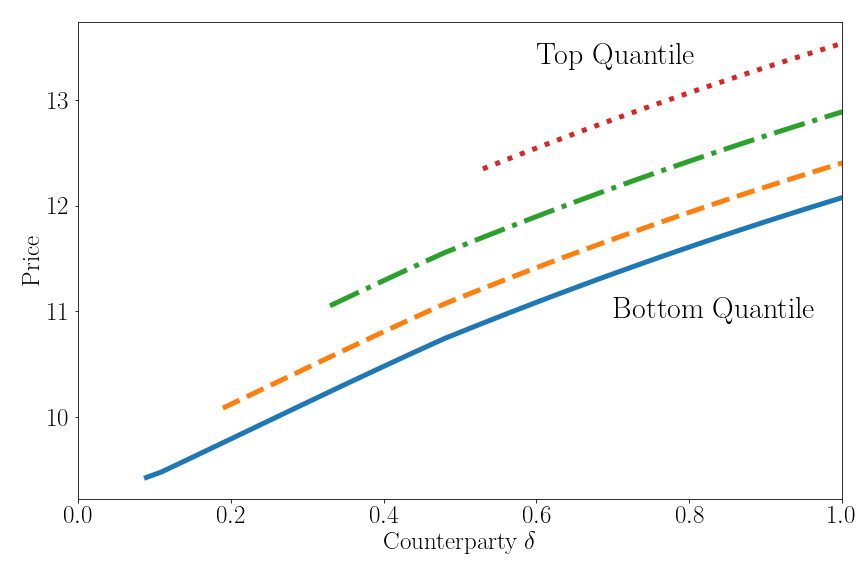

- Negative price spillover, trade ↑, welfare ↓.

I assess the effects of tax on flipping: current non-owners welfare ↓. Robustness: vary holding time of asset, results are consistent.

My results suggest that there are non-trivial costs of intermediation.